52+ why isn't my mortgage interest deductible this year

Web The IRS places several limits on the amount of interest that you can deduct each year. Web On your 1098 tax form is the following information.

Why Your Mortgage Interest Tax Deduction Doesn T Really Help Much The Motley Fool

You paid 4800 in.

. Web The mortgage interest deduction got a new limit One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. You may still be able to.

If your standard deduction is more than your itemized deductions which also includes state. 750000 if the loan was finalized after Dec. As noted in general you can deduct the mortgage.

This itemized deduction allows homeowners to subtract mortgage interest from their taxable. The terms of the loan are the same as for other 20-year loans offered in your area. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately.

Web You must itemize to benefit from mortgage interest and property tax deductions. Web The mortgage interest deduction is a tax incentive for homeowners. TurboTax is working correctly.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill.

Web I entered the first interest amount and the tax owed did not decrease. Box 3 Mortgage origination date. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000.

Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Answer Simple Questions About Your Life And We Do The Rest. Web Taxpayers who took out a mortgage after Dec.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Due to the changes in the tax law for 2018 the standard deduction has almost. Box 2 Outstanding mortgage principle.

Box 1 Interest paid not including points. Households claiming the home mortgage interest deduction declined.

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

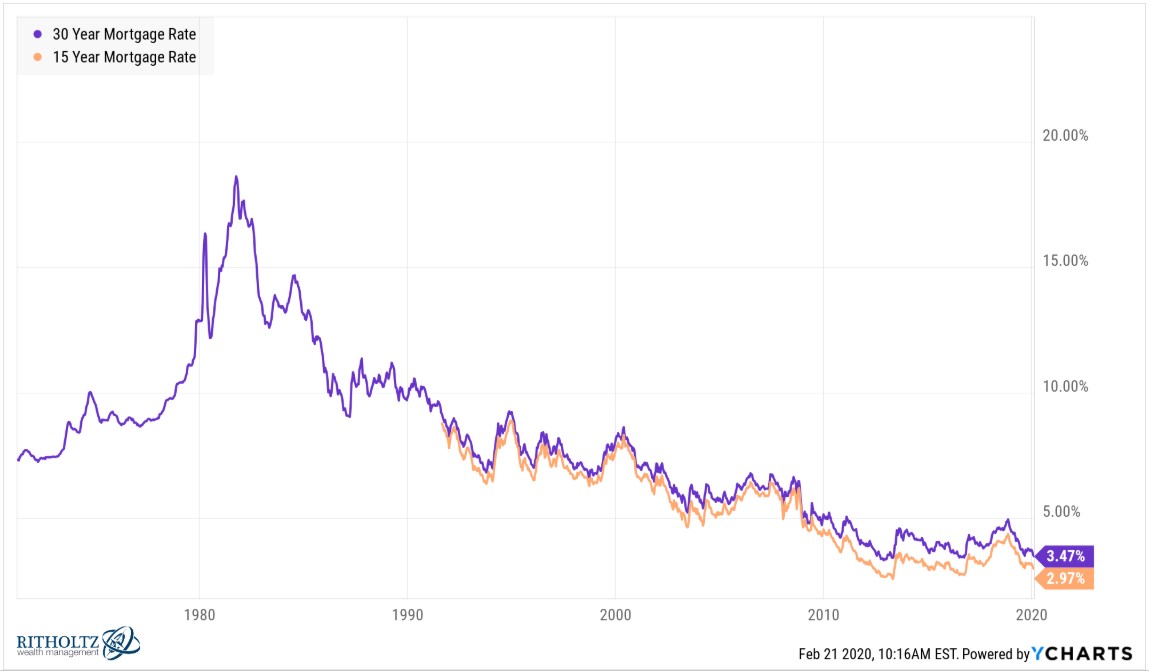

Should You Pay Off Your Mortgage Early With Rates So Low

Mortgage Interest Deduction What You Need To Know For Filing In 2022 Rismedia

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

German Reading Skills For Academic Purposes 0367186624 9780367186623 Dokumen Pub

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction How It Works In 2022 Wsj

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Tax Tips For Photographers To Maximize Your Take Home The Photo Argus

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Mortgage Interest Deduction Save When Filing Your Taxes

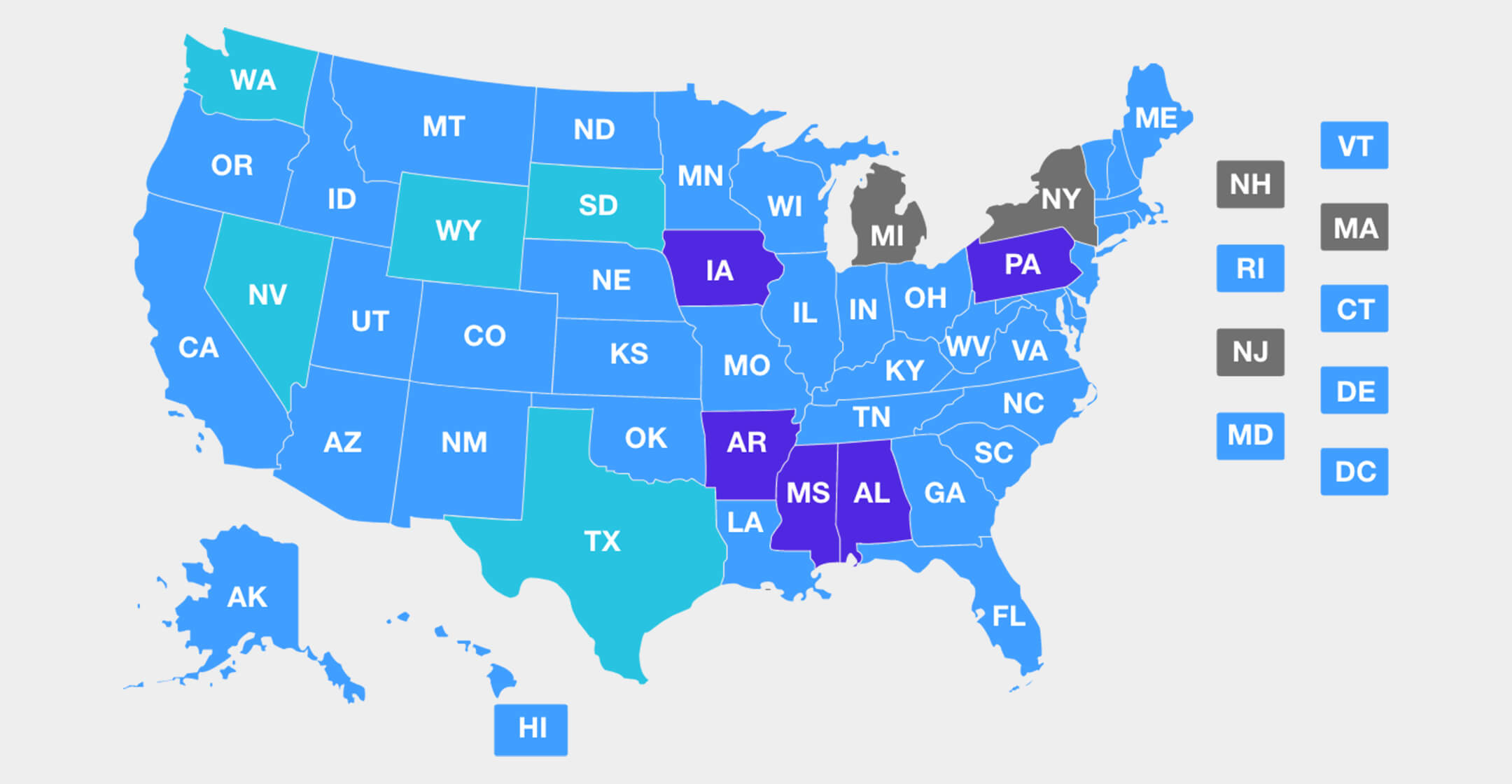

Does Your State Conform To Federal Tax Rules

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Calameo Wallstreetjournal 20160113 The Wall Street Journal

What Happened To Pasok Quora

Mortgage Interest Deduction What You Need To Know Mortgage Professional